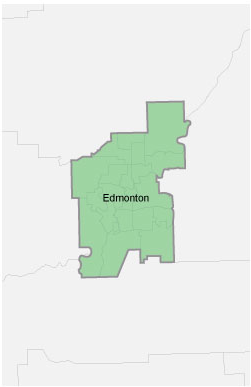

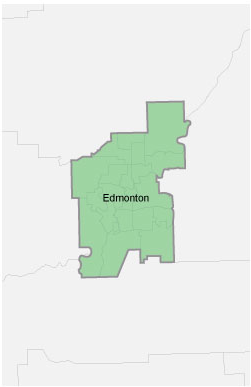

Edmonton, Alberta - EPCOR Utilities Inc. (EPCOR) today filed its quarterly results for the period ended June 30, 2025.

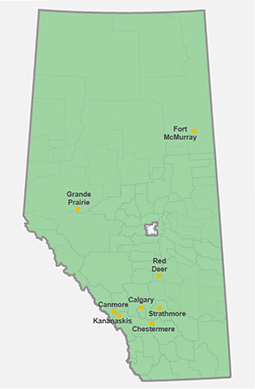

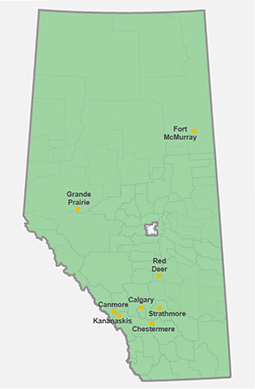

“EPCOR’s financial and operating performance was in line with expectations in the first half of 2025,” said John Elford, EPCOR President & CEO. “Across our regulated utility footprint in Edmonton and the United States, we saw continued strong growth in consumption and customer counts, both of which are key drivers of long-term financial performance in our business. Utility reliability performance and customer satisfaction ratings consistently met or exceeded benchmarks set by regulators, as our teams continued their focus on delivering a superior customer experience.”

“EPCOR continues to make substantial capital investments to support infrastructure renewal, improve reliability, and serve the needs of growing communities,” Mr. Elford said. “Our capital plan for 2025 contemplates more than $1 billion in investment to serve the customers of our regulated utilities and additional investments to support commercial growth. In the first half of 2025, our teams implemented capital expenditures totalling $472 million, sustaining momentum on regulated and commercial projects across our footprint.”

Highlights of EPCOR’s financial performance are as follows:

- Net income was $151 million and $254 million for the three and six months ended June 30, 2025, compared with net income of $104 million and $208 million for the comparative periods in 2024, respectively. The increase of $47 million and $46 million for the three and six months ended June 30, 2025, respectively, was primarily due to higher Adjusted EBITDA1 and fair value adjustments related to financial electricity purchase contracts, partially offset by higher depreciation and income tax expense. Additionally, for the six months ended June 30, 2025, there were higher transmission system access service charge net collections.

- Adjusted EBITDA1 was $311 million and $600 million for the three and six months ended June 30, 2025, compared with $274 million and $534 million for the comparative periods in 2024, respectively. The increase of $37 million and $66 million for the three and six months ended June 30, 2025, respectively, was primarily due to higher rates, consumption, customer growth, and regulated electricity margins, partially offset by higher staff costs.

- Capital expenditures were $472 million for the six months ended June 30, 2025, compared with $431 million for the corresponding period in 2024.