EPCOR Utilities Inc. (EPCOR) today filed its quarterly results for the period ended June 30, 2024.

“EPCOR’s second quarter financial performance was in line with expectations, reflecting continued customer growth across the company’s footprint and higher levels of commercial activity,” said John Elford, EPCOR President & CEO. “The safety and reliability of utility systems remains top of mind for us and our customers.”

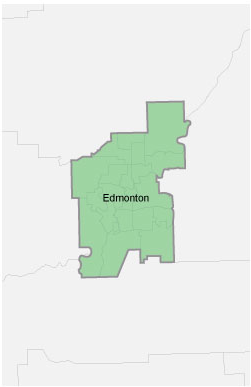

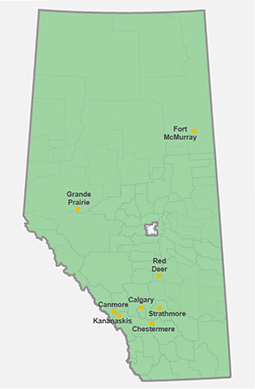

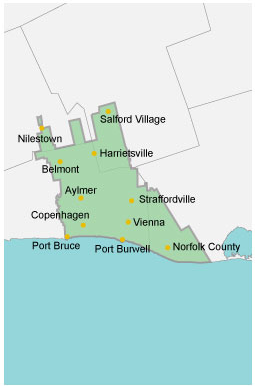

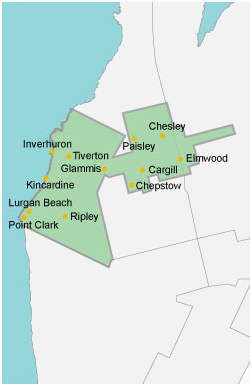

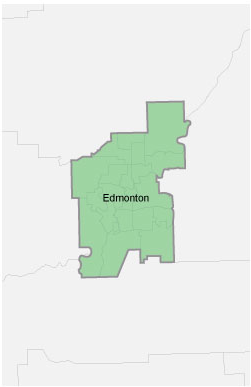

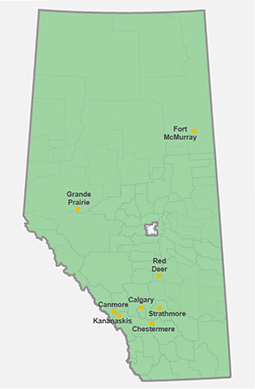

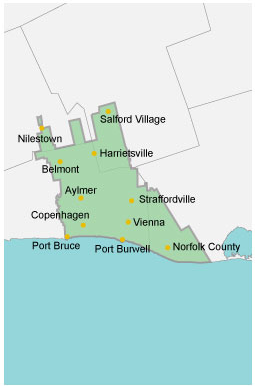

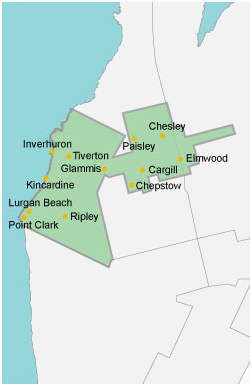

“Commercial growth in our U.S. operations remained on-track, as EPCOR’s progress continued on the construction of two commercial water projects in Texas, and we funded $134 million of our long-term investment in the groundwater supply system,” said Mr. Elford. “Several regulated and commercial projects reached milestones in the second quarter. At the Genesee power plant site in Alberta, we energized and placed into service electricity transmission infrastructure that connects new generation units to the provincial grid, strengthening access to power supplies. In Ontario, EPCOR has begun supplying demineralized water to the Darlington nuclear facility as part of the project’s performance testing phase. As previously announced, EPCOR also entered into an agreement to acquire the water and wastewater utility systems for the master-planned community of Harmony near Calgary, with regulatory approvals expected later this year.”

Highlights of EPCOR’s financial performance are as follows:

- Net income was $104 million and $208 million for the three and six months ended June 30, 2024, compared with net income of $102 million and $148 million for the comparative periods in 2023, respectively. The increase of $2 million for the three months ended June 30, 2024 was primarily due to higher Adjusted EBITDA1, partially offset by fair value adjustments related to financial electricity purchase contracts. The increase of $60 million for the six months ended June 30, 2024 was primarily due to higher Adjusted EBITDA1, and fair value adjustments related to financial electricity purchase contracts, partially offset by lower transmission system access service charge net collections and higher income tax expense.

- Adjusted EBITDA1 was $274 million and $534 million for the three and six months ended June 30, 2024, compared with $258 million and $502 million for the comparative periods in 2023, respectively. The increase of $16 million and $32 million for the three and six months ended June 30, 2024, was primarily due to higher rates, and higher commercial activity, partially offset by lower construction activity.

- Capital expenditures were $431 million for the six months ended June 30, 2024, compared with $445 million for the corresponding period in 2023.