EPCOR Utilities Inc. (EPCOR) today filed its annual and fourth quarter results for 2023.

“Throughout 2023, EPCOR's people provided reliable utility services to customers across our North American footprint, while maintaining an exceptional safety record and strong operational performance," said John Elford, EPCOR President & CEO. “Financial performance was ahead of expectations across utilities in Canada and the U.S., with steady growth in our regulated utilities and strong performance from commercial development projects."

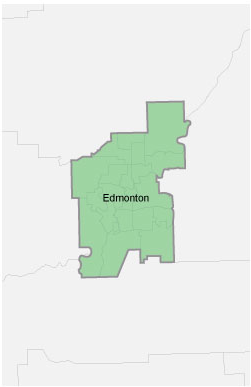

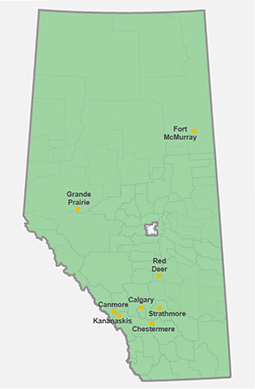

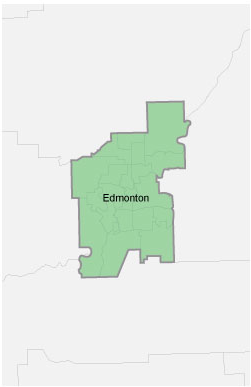

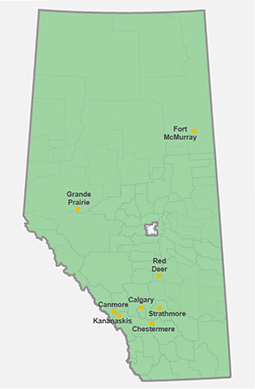

“Our capital investments of nearly $1 billion demonstrates our commitment to improving reliability and meeting increased demands for services on both sides of the border. This includes construction of a new substation at Genesee in Alberta and expansion of a wastewater treatment plant west of Phoenix, to accommodate new industrial and commercial customers. Additionally, we invested in utility infrastructure relocates to support City of Edmonton construction projects, and continued to advance flood mitigation projects to protect water treatment facilities from the impacts of climate change."

“EPCOR's commitment to a sustainable future for communities is also reflected in our financial planning. The Company's $750 million syndicated bank credit facility has been amended to tie our financing costs to achieving goals to reduce greenhouse gas emissions, improve gender diversity in the workplace, and deliver affordable services to our customers."

“Considering another year of strong business performance and solid prospects for continued growth, as previously announced, EPCOR will be increasing the dividend to our shareholder to $193 million in 2024. This is an $8 million increase over 2023 and will be the third year in a row where the dividend has grown."

Highlights of EPCOR's financial performance are as follows:

- Net income was $95 million and $361 million for the three months and year ended December 31, 2023, compared with net income of $93 million and $379 million for the comparative periods in 2022, respectively. The increase of $2 million for the three months ended December 31, 2023 was primarily due to higher Adjusted EBITDA1 and transmission system access service charge net collections, partially offset by fair value adjustments related to financial electricity purchase contracts. The decrease of $18 million for the year ended December 31, 2023 was primarily due to fair value adjustments related to financial electricity purchase contracts and higher depreciation and finance expenses in 2023, partially offset by higher Adjusted EBITDA1.

- Adjusted EBITDA1 was $256 million and $1,061 million for the three months and year ended December 31, 2023, compared with $223 million and $930 million for the comparative periods in 2022, respectively. The increase of $33 million and $131 million for the three months and year ended December 31, 2023, respectively, was primarily due to higher construction activity, higher rates and customer growth, partially offset by higher operating costs.

- Investment in capital projects was $988 million for the year ended December 31, 2023, compared with $920 million for the corresponding year in 2022, increased primarily due to higher capital expenditures on the construction of a new substation to facilitate interconnection of two power generation units in Alberta and construction of a new wastewater treatment facility in Arizona.