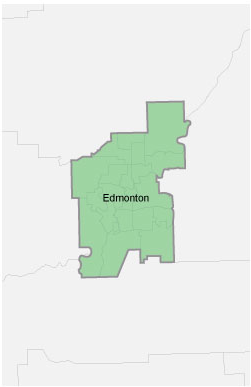

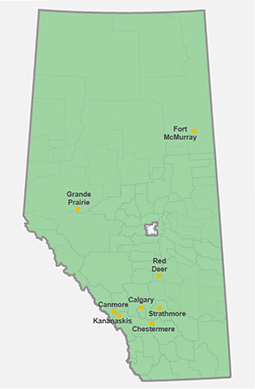

Edmonton, Alberta - EPCOR Utilities Inc. (EPCOR) today filed its quarterly results for the period ended September 30, 2025.

“EPCOR’s financial and operating performance was better than expectations in the first nine months of 2025,” said John Elford, EPCOR President & CEO. “We saw continued growth in our existing utility businesses, and solid execution of our capital program with investments in utility reliability, environmental performance, and community growth and resilience. In the first nine months of 2025 capital expenditures totalled $779 million, an increase of nearly 15% year-over-year.

“Based on the forecast performance of our business, EPCOR is increasing the dividend to our shareholder, the City of Edmonton, from $201 million in 2025 to $206 million in 2026,” Mr. Elford said. “From 2021 to 2026, the dividend will have grown by $35 million, a cumulative increase of more than 20%. EPCOR continues to have a balanced commitment to delivering sustainable dividend growth, offering reasonable rates, maintaining a financially stable business, and investing in growth.”

“As part of our strategy, we regularly assess EPCOR’s businesses and assets, and seek to recycle capital into new growth opportunities,” continued Mr. Elford. “We have taken a number of steps this year to realign our portfolio. In addition to the sale of our Texas natural gas utility earlier in 2025, we recently closed on transferring the Blue Sky Water Reclamation Facility to Samsung Austin Semiconductor, LLC. The proceeds from these transactions will support continued growth and investment in both our regulated utilities and in contracted commercial partnerships.”

Highlights of EPCOR’s financial performance are as follows:

- Net income was $132 million and $386 million for the three and nine months ended September 30, 2025, compared with net income of $131 million and $339 million for the comparative periods in 2024, respectively. The increase of $1 million for the three months ended September 30, 2025, was primarily due to higher transmission system access service charge net collections, other income and gain (loss) on disposals, partially offset by fair value adjustments related to financial electricity purchase contracts, higher depreciation expense and lower Adjusted EBITDA1. The increase of $47 million for the nine months ended September 30, 2025, was primarily due to higher Adjusted EBITDA1, higher transmission system access service charge net collections, partially offset by higher depreciation and income tax expenses and fair value adjustments related to financial electricity purchase contracts.

- Adjusted EBITDA1 was $321 million and $921 million for the three and nine months ended September 30, 2025, compared with $326 million and $860 million for the comparative periods in 2024, respectively. The decrease of $5 million for the three months ended September 30, 2025, was primarily due to lower construction activity and related margins and higher staff and operating costs, partially offset by higher regulated electricity margins, rates, customer growth and higher commercial activity. The increase of $61 million for the nine months ended September 30, 2025, was primarily due to higher regulated electricity margins, rates, consumption per customer, customer growth and higher commercial activity, partially offset by higher staff and operating costs and lower construction activity and related margins.

- Capital expenditures were $779 million for the nine months ended September 30, 2025, compared with $680 million for the corresponding period in 2024.