EPCOR Utilities Inc. (EPCOR) today filed its quarterly results for the period ended June 30, 2023.

“EPCOR’s operational and financial performance was in-line with expectations for the first half of the year,” said John Elford, EPCOR President & CEO. “As customer growth continues across our North American footprint, our teams are focused on ensuring continued delivery of reliable utility services and the completion of capital and construction projects that are now in progress. Capital projects include an electrical substation and transmission assets that will support new power generation supply in Alberta, a new wastewater treatment facility in Arizona, and a water treatment plant at the Darlington Nuclear Generating station. In addition, we continued to develop a groundwater supply system and an industrial water reclamation facility in central Texas, recording $753 million in construction revenues related to those projects in the first half of 2023.”

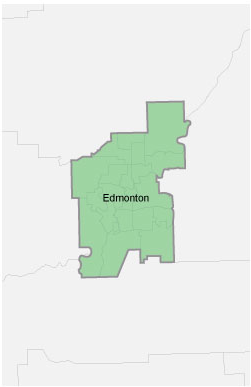

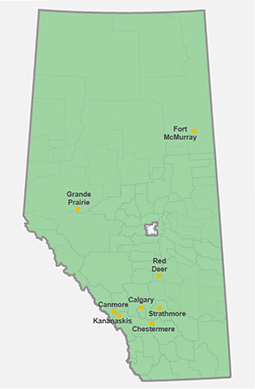

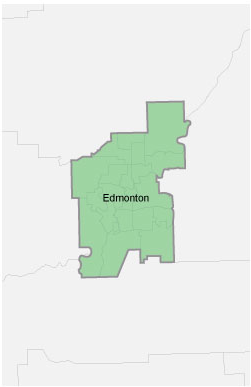

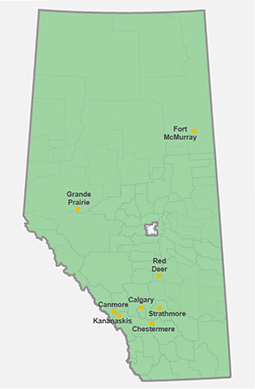

“In Alberta, wholesale electricity prices remained volatile,” continued Mr. Elford. “Higher spring temperatures drove increased power consumption province-wide, with the system operator reporting pressure on Alberta’s electricity grid. EPCOR continues to work closely with customers to manage their accounts, and with the Government of Alberta and industry to explore options for addressing affordability. Our competitive energy retailer, Encor by EPCOR, continues to see significant uptake on fixed rate plans as customers seek to manage their energy costs.”

Highlights of EPCOR’s financial performance are as follows:

- Net income was $102 million and $148 million for the three and six months ended June 30, 2023, compared with net income of $93 million and $167 million for the comparative periods in 2022, respectively. The increase of $9 million and decrease of $19 million for the three and six months ended June 30, 2023, respectively, was primarily due to fair value adjustments related to financial electricity purchase contracts, higher depreciation and finance expenses in 2023, partially offset by higher Adjusted EBITDA, as described below.

- Adjusted EBITDA1 was $258 million and $502 million for the three and six months ended June 30, 2023, compared with $233 million and $442 million for the comparative periods in 2022, respectively. The increase of $25 million and $60 million for the three and six months ended June 30, 2023, respectively, was primarily due to higher construction activity, customer growth and rates, partially offset by higher operating costs.

- Investment in capital projects was $445 million for the six months ended June 30, 2023, compared with $388 million for the corresponding period in 2022, primarily due to higher spending in EPCOR’s Distribution and Transmission segment and U.S. Operations segment, partially offset by lower capital spending in EPCOR’s Water Services segment.