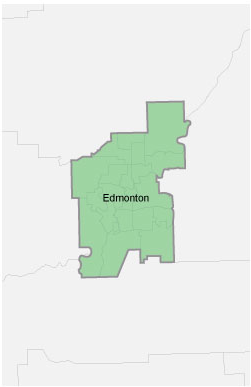

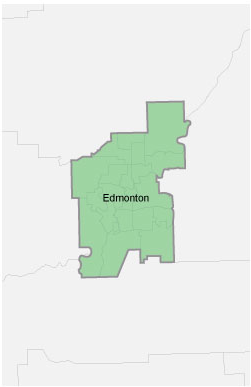

Edmonton, Alberta - EPCOR Utilities Inc. (EPCOR) today filed its quarterly results for the three months and year-to-date period ended September 30, 2022.

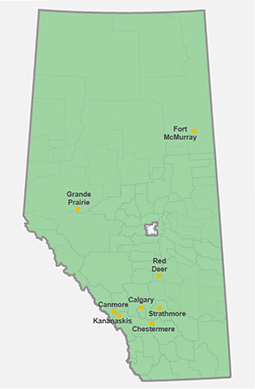

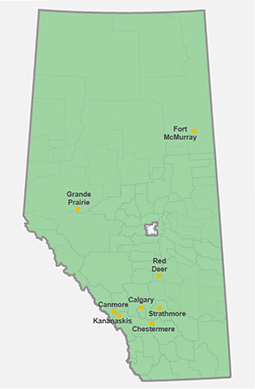

“EPCOR’s year-to-date operating and financial performance continued to be ahead of expectations across EPCOR’s utilities and geographies” said Stuart Lee, EPCOR President & CEO. “We saw strong customer growth in our Edmonton and U.S. utilities, and EPCOR teams and contractors completed more than $240 million in capital projects in the third quarter, helping to sustain infrastructure reliability, support growing communities, and improve environmental performance.”

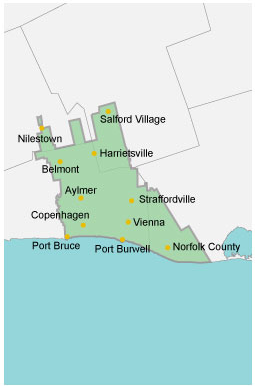

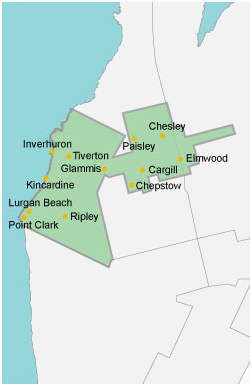

“EPCOR’s footprint continues to grow across Canada and the United States, with commercial and contracted opportunities accelerating in our U.S. business,” continued Mr. Lee. “Based on the forecast performance of our existing businesses over the next five years, the EPCOR dividend has been increased by 4.5% from $177 million to $185 million in 2023. We continue to pursue a balanced approach to long-term value creation – investing in reliable utility services while protecting ratepayers, and delivering a strong, stable dividend while also re-investing in the business to deliver sustained income and dividend growth.”

Highlights of EPCOR’s financial performance are as follows:

- Net income was $119 million and $286 million for the three and nine months ended September 30, 2022, compared with net income of $146 million and $287 million for the comparative periods in 2021, respectively. The decrease of $27 million and $1 million for the three and nine months ended September 30, 2022, respectively, was primarily due to the gain recognized on expropriation of the Bullhead City (BHC) water utility systems in the third quarter of 2021, lower transmission system access service charge net collections and higher depreciation, partially offset by higher Adjusted EBITDA, as described below, and favorable fair value adjustments related to financial electricity purchase contracts. In addition, for the nine months ended September 30, 2022, there was higher net collection of U.S. natural gas procurement costs.

- Adjusted EBITDA was $265 million and $707 million for the three and nine months ended September 30, 2022, compared with $227 million and $640 million for the comparative periods in 2021, respectively. The increase of $38 million and $67 million for the three and nine months ended September 30, 2022, respectively, was primarily due to higher rates and customer growth, higher construction margins due to a new project in central Texas and lower staff costs, partially offset by lower Adjusted EBITDA due to the expropriation of BHC in 2021, higher provision for expected credit losses from customers and higher purchased water costs to support growth in the US. For the nine months ended September 30, 2022, there were higher Energy Price Setting Plan margins.

- Investment in capital projects was $631 million for the nine months ended September 30, 2022, compared with $730 million for the corresponding period in 2021, primarily due to the acquisition of San Tan operations in 2021 with no corresponding acquisition in 2022, partially offset by higher capital spending in the Company’s Water Services, Distribution and Transmission and U.S. Operations segments.