In 2019, the federal government implemented a carbon tax for fossil fuels as part of the Greenhouse Gas Pollution Pricing Act (GGPPA) and its carbon pricing program. The tax is designed to lower Canada's carbon emissions to meet the targets it agreed to at the Paris climate summit.

Monthly bill charge

Effective August 1, 2019, you will see a new line item on your monthly bill: Federal Carbon Charge. This charge recovers costs associated with the GGPPA that EPCOR remits to the government on your behalf.

The federal carbon charge for natural gas is 7.83 cents per cubic metre, increasing annually.

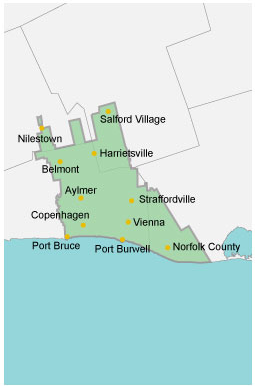

Carbon rebate for Ontario residents

As part of the Climate Action Incentive payment, the federal government has indicated that most of the proceeds it collects through the carbon charge will be returned to Ontario residents as a rebate. As a household, you could receive approximately $300 a year after claiming the incentive on your annual tax return.

Greenhouse operators partial relief

The federal government has released draft regulations related to greenhouse operations. As part of the draft, commercial greenhouse operators may be eligible for partial relief through the use of an exemption certificate. If applicable, just 20% of the federal carbon charge will apply to natural gas delivered by a registered distributor to a greenhouse operator.

Greenhouse operators must provide EPCOR with an exemption certificate to confirm partial relief. Before completing a fuel relief charge form below, a greenhouse operator must meet the following conditions:

- Operations meets the definition of a greenhouse operator and eligible greenhouse

- Greenhouse operator: a person that carries on a business of growing vegetables, fruits, bedding plants, flowers, ornamental plants, tree seedlings, medicinal plants or other plants in eligible greenhouses with a reasonable expectation of profit.

- Eligible greenhouse: a greenhouse where all or substantially all of its growing area is used for the growing of vegetables, fruits, bedding plants, flowers, ornamental plants, tree seedlings, medicinal plants or other plants.

- Business conducts eligible greenhouse activity

- Eligible greenhouse activity: the use of a qualifying greenhouse fuel to heat an eligible greenhouse or to supplement carbon dioxide in an eligible greenhouse in order to grow or produce plants.

- Qualifying greenhouse fuel: a type of fuel that is marketable natural gas (as defined in Section 3 of the GGPPA) or propane.

- Reviews and understands obligations of the draft regulation

- Part 5, Section 7 of the draft regulation states that if a qualifying greenhouse fuel delivered by a registered distributor is used by the greenhouse operator other than for eligible greenhouse activities, the greenhouse operator must pay a charge for the fuel to the federal government.

Once these conditions have been met greenhouse operators can apply for the exemption by completing Form L404 and submitting it to gas@epcor.com.

Program updates

We will keep you informed of updates to the federal carbon pricing program and the GGPPA on our website and on notices with your monthly bill. You can also learn more from the Government of Canada.